Non-Payment comprehensive Insurance

-

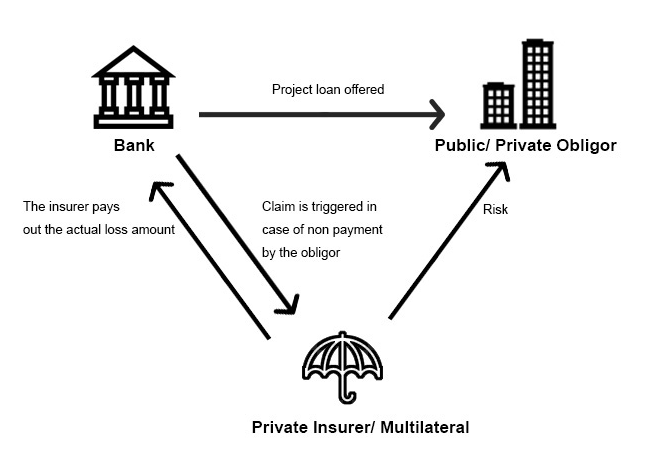

1. Product OverviewInsurance when the borrower fails to repay the loan, banks and other financial institutions are insured. Most lenders usually sign up for other financial institutions, etc., but insurance coverage can allow the lender to take on the full loan amount without the intervention of another bank. Insurance acts as a stop loss arrangement, so the lender leverages the bank's line of credit for the debtor/country/loan type and assists the bank in obtaining capital relief.s

-

2. Structure of this Insurance

-

3. Content of Coverage

the non-performance of arbitral awards by public sector counterparties in the capacity of the insured as a contractual partner; Or, in the case of a private sector counterpart, the action of the host national government to cause the other party to default on the arbitral award.

Compensation losses incurred due to breach of the terms of the contract due to the inability to pay as agreed. This is a personal party or a public debtor. Depending on the direction of the host call, the matters include the inability to export due to the cancellation of the business license.

Contracts with the support of the sovereign are usually issued by the joint sovereign entity to support the project.

Failure to fulfill the payment obligations under the warranty contract. These payments can be in the form of direct loans, loan guarantees, letters of credit issued by state-owned banks, etc.